Regulations on export to Singapore

When you send your luggage to Singapore, Please check the following transport, and the regulations on import and export.

Although we pay close attention to the accuracy of the information, the laws and regulations of each country and region are subject to change. Please be sure to check the import regulations of each country before using.

Shipping fee to Singapore is here >>

Contraband list for Singapore

The restrictions on the items that can be sent vary depending on the delivery method. For more details, please check the restrictions of each shipping method below.

Super Express

Standard Express

Economy Air

Surface

Those that can not be sent all over the world common

Combustible articles, high-pressure articles, etc. For details, please see "Products that cannot be delivered overseas".

Items that cannot be delivered to Singapore

| Food and beverages (incl. alcoholic drinks) | We cannot accept requests for shipping food products, supplements, or alcohol. |

|---|---|

| Pharmaceuticals and hygiene products | Pharmaceuticals and contact lenses are not accepted for shipment |

| Electrical Appliances | ・The number of electrical appliances for personal use is limited (up to 5 items) ・A license is required for items with wireless capability ・There are restrictions for products containing lithium batteries, regarding the type (lithium ion, lithium metal) and quantity (max. 2 per package). |

| Chemical products (detergents, liquids, cosmetics, etc.) | An SDS may be required for chemical products (detergents, liquids, cosmetics, etc.) |

| Leather and brand goods | A quarantine inspection certificate may be required for leather goods. |

| Other products of note | For single shipments valued at SGD400 or less, the Goods and Services Tax (GST) of 9% of the total value of the goods listed on the invoice, international shipping costs and other fees incurred, will be added to the shipping payment by Rakuten Global Express. Rakuten Global Express will declare and pay the Goods and Services Tax (GST) to the authorities on your behalf. |

Those that can not be sent all over the world common

Combustible articles, high-pressure articles, etc. For details, please see "Products that cannot be delivered overseas".

Items that cannot be delivered to Singapore

| Food and beverages (incl. alcoholic drinks) | ・Processed foods must be approved by the relevant authority (Agri-Food and Veterinary Authority) in advance if the total weight exceeds 5 kg and the price exceeds SGD100. ・Chewing gum, fat-free milk, and high-risk marine products (refrigerated raw oysters, refrigerated shellfish, refrigerated cooked shrimp, refrigerated crab meat) are not able to be imported ・Depending on the production area, some foods produced in Fukushima Prefecture are not able to be imported. Alternatively, a radioactive materials inspection report issued by an inspection agency is required ・Marine products produced in Ibaraki, Tochigi, and Gunma prefectures require a radioactive materials inspection certificate prepared by the government ・For other items and products from other areas, a certificate of origin for each prefecture is required. The certificate must be prepared by the government or chamber of commerce (accompanied by a verification of signature if a chamber of commerce) |

|---|---|

| Cosmetics | HSA approval is required to import cosmetics. However, the HSA allows import for personal use when within common sense quantities for personal use. |

| Pharmaceuticals and hygiene products | Imports of pharmaceuticals must be done through the holder of a license obtained from the HSA. |

| Electrical Appliances | There are restrictions for products containing lithium batteries, regarding the type (lithium ion, lithium metal) and quantity (max. 2 per package). |

| Precious stones and metals | We do not offer shipping for high value items or accessories which include precious metals, etc. |

| Other products of note | ・Imports of tax-exempt and uncontrolled items with a total CIF of no more than SGD400 are exempt from import licenses and GST payments. They will be delivered to the consignee by Singapore Post (SP). The consignee is required to present invoices when receiving the items. ・There are no tax exemptions for imports of taxable and non-taxable items in parcels sent through international post when the total CIF exceeds SGD400. The postal parcel is stored at the Singapore Post Center (SPC) of the Immigration and Checkpoints Authority (ICA). The consignee who has received a summons can receive the package after having obtained an approval of import and paying the relevant taxes. |

| Other products of note | For single shipments valued at SGD400 or less, the Goods and Services Tax (GST) of 9% of the total value of the goods listed on the invoice, international shipping costs and other fees incurred, will be added to the shipping payment by Rakuten Global Express. Rakuten Global Express will declare and pay the Goods and Services Tax (GST) to the authorities on your behalf. |

Those that can not be sent all over the world common

Combustible articles, high-pressure articles, etc. For details, please see "Products that cannot be delivered overseas".

Items that cannot be delivered to Singapore

| Food and beverages (incl. alcoholic drinks) | ・Processed foods must be approved by the relevant authority (Agri-Food and Veterinary Authority) in advance if the total weight exceeds 5 kg and the price exceeds SGD100. ・Chewing gum, fat-free milk, and high-risk marine products (refrigerated raw oysters, refrigerated shellfish, refrigerated cooked shrimp, refrigerated crab meat) are not able to be imported ・Depending on the production area, some foods produced in Fukushima Prefecture are not able to be imported. Alternatively, a radioactive materials inspection report issued by an inspection agency is required ・Marine products produced in Ibaraki, Tochigi, and Gunma prefectures require a radioactive materials inspection certificate prepared by the government ・For other items and products from other areas, a certificate of origin for each prefecture is required. The certificate must be prepared by the government or chamber of commerce (accompanied by a verification of signature if a chamber of commerce) |

|---|---|

| Cosmetics | HSA approval is required to import cosmetics. However, the HSA allows import for personal use when within common sense quantities for personal use. |

| Pharmaceuticals and hygiene products | Imports of pharmaceuticals must be done through the holder of a license obtained from the HSA. |

| Electrical Appliances | There are restrictions for products containing lithium batteries, regarding the type (lithium ion, lithium metal) and quantity (max. 2 per package). |

| Precious stones and metals | We do not offer shipping for high value items or accessories which include precious metals, etc. |

| Other products of note | ・ We cannot ship packages with individual value (in the case of multiple products, the total value) of over 200,000 yen. ・Books, CDs, and DVDs require an import license. ・Other than items restricted for import and controlled items, if not exceeding SGD400, the item will go through simplified customs clearance. Simplified customs clearance is entirely exempt from tax. If multiple packages are shipped to the same address on the same day, their invoiced prices will be totaled. If the total invoiced price exceeds SGD400, an import license is required. ・Imports of tax-exempt and uncontrolled items with a total CIF of no more than SGD400 are exempt from import licenses and GST payments. They will be delivered to the consignee by Singapore Post (SP). The consignee is required to present invoices when receiving the items. ・There are no tax exemptions for imports of taxable and non-taxable items in parcels sent through international post when the total CIF exceeds SGD400. The postal parcel is stored at the Singapore Post Center (SPC) of the Immigration and Checkpoints Authority (ICA). The consignee who has received a summons can receive the package after having obtained an approval of import and paying the relevant taxes. |

| Other products of note | For single shipments valued at SGD400 or less, the Goods and Services Tax (GST) of 9% of the total value of the goods listed on the invoice, international shipping costs and other fees incurred, will be added to the shipping payment by Rakuten Global Express. Rakuten Global Express will declare and pay the Goods and Services Tax (GST) to the authorities on your behalf. |

Those that can not be sent all over the world common

Combustible articles, high-pressure articles, etc. For details, please see "Products that cannot be delivered overseas".

Items that cannot be delivered to Singapore

| Food and beverages (incl. alcoholic drinks) | ・Processed foods must be approved by the relevant authority (Agri-Food and Veterinary Authority) in advance if the total weight exceeds 5 kg and the price exceeds SGD100. ・Chewing gum, fat-free milk, and high-risk marine products (refrigerated raw oysters, refrigerated shellfish, refrigerated cooked shrimp, refrigerated crab meat) are not able to be imported ・Depending on the production area, some foods produced in Fukushima Prefecture are not able to be imported. Alternatively, a radioactive materials inspection report issued by an inspection agency is required ・Marine products produced in Ibaraki, Tochigi, and Gunma prefectures require a radioactive materials inspection certificate prepared by the government ・For other items and products from other areas, a certificate of origin for each prefecture is required. The certificate must be prepared by the government or chamber of commerce (accompanied by a verification of signature if a chamber of commerce) |

|---|---|

| Cosmetics | HSA approval is required to import cosmetics. However, the HSA allows import for personal use when within common sense quantities for personal use. |

| Pharmaceuticals and hygiene products | Imports of pharmaceuticals must be done through the holder of a license obtained from the HSA. |

| Electrical Appliances | There are restrictions for products containing lithium batteries, regarding the type (lithium ion, lithium metal) and quantity (max. 2 per package). |

| Other products of note | ・Imports of tax-exempt and uncontrolled items with a total CIF of no more than SGD400 are exempt from import licenses and GST payments. They will be delivered to the consignee by Singapore Post (SP). The consignee is required to present invoices when receiving the items. ・There are no tax exemptions for imports of taxable and non-taxable items in parcels sent through international post when the total CIF exceeds SGD400. The postal parcel is stored at the Singapore Post Center (SPC) of the Immigration and Checkpoints Authority (ICA). The consignee who has received a summons can receive the package after having obtained an approval of import and paying the relevant taxes. |

| Other products of note | For single shipments valued at SGD400 or less, the Goods and Services Tax (GST) of 9% of the total value of the goods listed on the invoice, international shipping costs and other fees incurred, will be added to the shipping payment by Rakuten Global Express. Rakuten Global Express will declare and pay the Goods and Services Tax (GST) to the authorities on your behalf. |

-

Those that can not be sent all over the world common

Combustible articles, high-pressure articles, etc. For details, please see "Products that cannot be delivered overseas".

Items that cannot be delivered to Singapore

- Food and beverages (incl. alcoholic drinks)

- We cannot accept requests for shipping food products, supplements, or alcohol.

- Pharmaceuticals and hygiene products

- Pharmaceuticals and contact lenses are not accepted for shipment

- Electrical Appliances

- ・The number of electrical appliances for personal use is limited (up to 5 items)

・A license is required for items with wireless capability

・There are restrictions for products containing lithium batteries, regarding the type (lithium ion, lithium metal) and quantity (max. 2 per package). - Chemical products (detergents, liquids, cosmetics, etc.)

- An SDS may be required for chemical products (detergents, liquids, cosmetics, etc.)

- Leather and brand goods

- A quarantine inspection certificate may be required for leather goods.

- Other products of note

- For single shipments valued at SGD400 or less, the Goods and Services Tax (GST) of 9% of the total value of the goods listed on the invoice, international shipping costs and other fees incurred, will be added to the shipping payment by Rakuten Global Express. Rakuten Global Express will declare and pay the Goods and Services Tax (GST) to the authorities on your behalf.

-

Those that can not be sent all over the world common

Combustible articles, high-pressure articles, etc. For details, please see "Products that cannot be delivered overseas".

Items that cannot be delivered to Singapore

- Food and beverages (incl. alcoholic drinks)

- ・Processed foods must be approved by the relevant authority (Agri-Food and Veterinary Authority) in advance if the total weight exceeds 5 kg and the price exceeds SGD100.

・Chewing gum, fat-free milk, and high-risk marine products (refrigerated raw oysters, refrigerated shellfish, refrigerated cooked shrimp, refrigerated crab meat) are not able to be imported

・Depending on the production area, some foods produced in Fukushima Prefecture are not able to be imported. Alternatively, a radioactive materials inspection report issued by an inspection agency is required

・Marine products produced in Ibaraki, Tochigi, and Gunma prefectures require a radioactive materials inspection certificate prepared by the government

・For other items and products from other areas, a certificate of origin for each prefecture is required. The certificate must be prepared by the government or chamber of commerce (accompanied by a verification of signature if a chamber of commerce) - Cosmetics

- HSA approval is required to import cosmetics. However, the HSA allows import for personal use when within common sense quantities for personal use.

- Pharmaceuticals and hygiene products

- Imports of pharmaceuticals must be done through the holder of a license obtained from the HSA.

- Electrical Appliances

- There are restrictions for products containing lithium batteries, regarding the type (lithium ion, lithium metal) and quantity (max. 2 per package).

- Precious stones and metals

- We do not offer shipping for high value items or accessories which include precious metals, etc.

- Other products of note

- ・Imports of tax-exempt and uncontrolled items with a total CIF of no more than SGD400 are exempt from import licenses and GST payments. They will be delivered to the consignee by Singapore Post (SP). The consignee is required to present invoices when receiving the items.

・There are no tax exemptions for imports of taxable and non-taxable items in parcels sent through international post when the total CIF exceeds SGD400. The postal parcel is stored at the Singapore Post Center (SPC) of the Immigration and Checkpoints Authority (ICA). The consignee who has received a summons can receive the package after having obtained an approval of import and paying the relevant taxes. - Other products of note

- For single shipments valued at SGD400 or less, the Goods and Services Tax (GST) of 9% of the total value of the goods listed on the invoice, international shipping costs and other fees incurred, will be added to the shipping payment by Rakuten Global Express. Rakuten Global Express will declare and pay the Goods and Services Tax (GST) to the authorities on your behalf.

-

Those that can not be sent all over the world common

Combustible articles, high-pressure articles, etc. For details, please see "Products that cannot be delivered overseas".

Items that cannot be delivered to Singapore

- Food and beverages (incl. alcoholic drinks)

- ・Processed foods must be approved by the relevant authority (Agri-Food and Veterinary Authority) in advance if the total weight exceeds 5 kg and the price exceeds SGD100.

・Chewing gum, fat-free milk, and high-risk marine products (refrigerated raw oysters, refrigerated shellfish, refrigerated cooked shrimp, refrigerated crab meat) are not able to be imported

・Depending on the production area, some foods produced in Fukushima Prefecture are not able to be imported. Alternatively, a radioactive materials inspection report issued by an inspection agency is required

・Marine products produced in Ibaraki, Tochigi, and Gunma prefectures require a radioactive materials inspection certificate prepared by the government

・For other items and products from other areas, a certificate of origin for each prefecture is required. The certificate must be prepared by the government or chamber of commerce (accompanied by a verification of signature if a chamber of commerce) - Cosmetics

- HSA approval is required to import cosmetics. However, the HSA allows import for personal use when within common sense quantities for personal use.

- Pharmaceuticals and hygiene products

- Imports of pharmaceuticals must be done through the holder of a license obtained from the HSA.

- Electrical Appliances

- There are restrictions for products containing lithium batteries, regarding the type (lithium ion, lithium metal) and quantity (max. 2 per package).

- Precious stones and metals

- We do not offer shipping for high value items or accessories which include precious metals, etc.

- Other products of note

- ・ We cannot ship packages with individual value (in the case of multiple products, the total value) of over 200,000 yen.

・Books, CDs, and DVDs require an import license.

・Other than items restricted for import and controlled items, if not exceeding SGD400, the item will go through simplified customs clearance. Simplified customs clearance is entirely exempt from tax. If multiple packages are shipped to the same address on the same day, their invoiced prices will be totaled. If the total invoiced price exceeds SGD400, an import license is required.

・Imports of tax-exempt and uncontrolled items with a total CIF of no more than SGD400 are exempt from import licenses and GST payments. They will be delivered to the consignee by Singapore Post (SP). The consignee is required to present invoices when receiving the items.

・There are no tax exemptions for imports of taxable and non-taxable items in parcels sent through international post when the total CIF exceeds SGD400. The postal parcel is stored at the Singapore Post Center (SPC) of the Immigration and Checkpoints Authority (ICA). The consignee who has received a summons can receive the package after having obtained an approval of import and paying the relevant taxes. - Other products of note

- For single shipments valued at SGD400 or less, the Goods and Services Tax (GST) of 9% of the total value of the goods listed on the invoice, international shipping costs and other fees incurred, will be added to the shipping payment by Rakuten Global Express. Rakuten Global Express will declare and pay the Goods and Services Tax (GST) to the authorities on your behalf.

-

Those that can not be sent all over the world common

Combustible articles, high-pressure articles, etc. For details, please see "Products that cannot be delivered overseas".

Items that cannot be delivered to Singapore

- Food and beverages (incl. alcoholic drinks)

- ・Processed foods must be approved by the relevant authority (Agri-Food and Veterinary Authority) in advance if the total weight exceeds 5 kg and the price exceeds SGD100.

・Chewing gum, fat-free milk, and high-risk marine products (refrigerated raw oysters, refrigerated shellfish, refrigerated cooked shrimp, refrigerated crab meat) are not able to be imported

・Depending on the production area, some foods produced in Fukushima Prefecture are not able to be imported. Alternatively, a radioactive materials inspection report issued by an inspection agency is required

・Marine products produced in Ibaraki, Tochigi, and Gunma prefectures require a radioactive materials inspection certificate prepared by the government

・For other items and products from other areas, a certificate of origin for each prefecture is required. The certificate must be prepared by the government or chamber of commerce (accompanied by a verification of signature if a chamber of commerce) - Cosmetics

- HSA approval is required to import cosmetics. However, the HSA allows import for personal use when within common sense quantities for personal use.

- Pharmaceuticals and hygiene products

- Imports of pharmaceuticals must be done through the holder of a license obtained from the HSA.

- Electrical Appliances

- There are restrictions for products containing lithium batteries, regarding the type (lithium ion, lithium metal) and quantity (max. 2 per package).

- Other products of note

- ・Imports of tax-exempt and uncontrolled items with a total CIF of no more than SGD400 are exempt from import licenses and GST payments. They will be delivered to the consignee by Singapore Post (SP). The consignee is required to present invoices when receiving the items.

・There are no tax exemptions for imports of taxable and non-taxable items in parcels sent through international post when the total CIF exceeds SGD400. The postal parcel is stored at the Singapore Post Center (SPC) of the Immigration and Checkpoints Authority (ICA). The consignee who has received a summons can receive the package after having obtained an approval of import and paying the relevant taxes. - Other products of note

- For single shipments valued at SGD400 or less, the Goods and Services Tax (GST) of 9% of the total value of the goods listed on the invoice, international shipping costs and other fees incurred, will be added to the shipping payment by Rakuten Global Express. Rakuten Global Express will declare and pay the Goods and Services Tax (GST) to the authorities on your behalf.

Goods and Services Tax (GST) amount judgment rate

4/2024 Judgment rate 1SGD = 112.3JPYAbout Packing & Delivery Mode

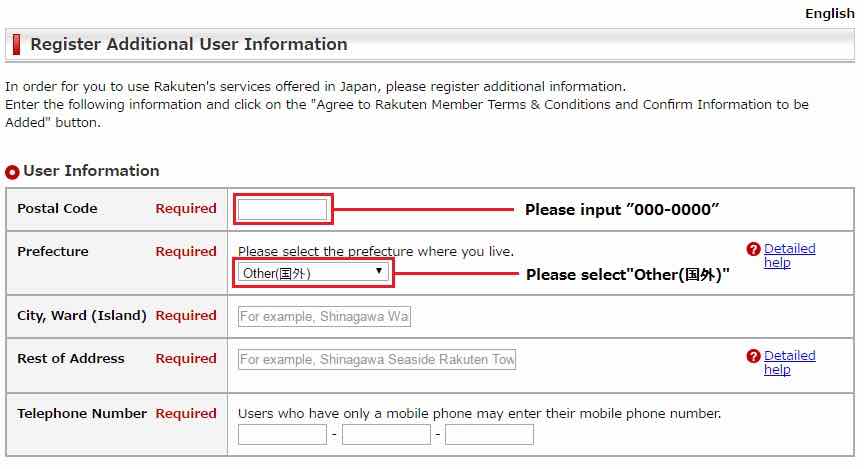

English

English