Regulations on export to Australia

When you send your luggage to Australia, Please check the following transport, and the regulations on import and export.

Although we pay close attention to the accuracy of the information, the laws and regulations of each country and region are subject to change. Please be sure to check the import regulations of each country before using.

Shipping fee to Australia is here >>

Contraband list for Australia

The restrictions on the items that can be sent vary depending on the delivery method. For more details, please check the restrictions of each shipping method below.

Super Express

Standard Express

Surface

Those that can not be sent all over the world common

Combustible articles, high-pressure articles, etc. For details, please see "Products that cannot be delivered overseas".

Items that cannot be delivered to Australia

| Food and beverages (incl. alcoholic drinks) | We do not accept shipping orders for food products, supplements and alcoholic beverages that require import clearance certificates or ingredients lists in advance. |

|---|---|

| Pharmaceuticals and hygiene products | We do not offer shipping for pharmaceuticals. |

| Electrical Appliances | There are restrictions for products containing lithium batteries, regarding the type (lithium ion, lithium metal) and quantity (max. 2 per package). |

| Chemical products (detergents, liquids, cosmetics, etc.) | An SDS may be required for chemical products (detergents, liquids, cosmetics, etc.) |

| Leather and brand goods | ・ Product details (product tags displaying material, composition) may be required. ・ Products manufactured in China require a certificate of origin. ・ A quarantine inspection certificate may be required for leather goods. |

| Other products of note | ・For shipments of greater than AUD1,000, you may be required to submit detailed product information and customs documents when making your import declaration. In addition, a Goods and Services Tax (GST) of 10% of the total value of the goods listed on the invoice, plus international shipping fees and other fees incurred, may be charged by the delivery company at the time of import declaration or delivery of the goods. ・For single shipments valued at AUD1,000 or less, the Goods and Services Tax (GST) of 10% of the total value of the goods listed on the invoice, international shipping costs and other fees incurred, will be added to the shipping payment by Rakuten Global Express. Rakuten Global Express will declare and pay the Goods and Services Tax (GST) to the authorities on your behalf. |

Those that can not be sent all over the world common

Combustible articles, high-pressure articles, etc. For details, please see "Products that cannot be delivered overseas".

Items that cannot be delivered to Australia

| Electrical Appliances | There are restrictions for products containing lithium batteries, regarding the type (lithium ion, lithium metal) and quantity (max. 2 per package). |

|---|---|

| Food and beverages (incl. alcoholic drinks) | ・ We cannot import fruits, vegeatbles and related processed products. ・ Food products containing seeds, nuts, fresh fruit or vegetables, etc must go through quarantine, regardless if for personal consumption or not. ・ We cannot import meat products, except for those that can be stored at room temperature (retort pouches, cans etc). ・ We cannot import cheese, milk or related dairy products. ・ We cannot import foods containing more than 10% eggs or dairy. ・ We cannot import honey. |

| Pharmaceuticals and hygiene products | The quantity restriction for pharmaceuticals in a single shipment is maximum 3 months worth as recommended by the manufacturer. |

| Precious stones and metals | We do not accept shipping orders for precious stones and metals or products containing them, such as accessories, etc. |

| Other goods | We do not accept shipping orders for tobacco. |

| Other products of note | ・For shipments of greater than AUD1,000, you may be required to submit detailed product information and customs documents when making your import declaration. In addition, a Goods and Services Tax (GST) of 10% of the total value of the goods listed on the invoice, plus international shipping fees and other fees incurred, may be charged by the delivery company at the time of import declaration or delivery of the goods. ・For single shipments valued at AUD1,000 or less, the Goods and Services Tax (GST) of 10% of the total value of the goods listed on the invoice, international shipping costs and other fees incurred, will be added to the shipping payment by Rakuten Global Express. Rakuten Global Express will declare and pay the Goods and Services Tax (GST) to the authorities on your behalf. |

Those that can not be sent all over the world common

Combustible articles, high-pressure articles, etc. For details, please see "Products that cannot be delivered overseas".

Items that cannot be delivered to Australia

| Food and beverages (incl. alcoholic drinks) | ・ We cannot import fruits, vegeatbles and related processed products. ・ Food products containing seeds, nuts, fresh fruit or vegetables, etc must go through quarantine, regardless if for personal consumption or not. ・ We cannot import meat products, except for those that can be stored at room temperature (retort pouches, cans etc). ・ We cannot import cheese, milk or related dairy products. ・ We cannot import foods containing more than 10% eggs or dairy. ・ We cannot import honey. |

|---|---|

| Pharmaceuticals and hygiene products | The quantity restriction for pharmaceuticals in a single shipment is maximum 3 months worth as recommended by the manufacturer. |

| Electrical Appliances | We do not accept shipping orders for products containing lithium batteries. |

| Other goods | We do not accept shipping orders for tobacco. |

| Other products of note | ・For shipments of greater than AUD1,000, you may be required to submit detailed product information and customs documents when making your import declaration. In addition, a Goods and Services Tax (GST) of 10% of the total value of the goods listed on the invoice, plus international shipping fees and other fees incurred, may be charged by the delivery company at the time of import declaration or delivery of the goods. ・For single shipments valued at AUD1,000 or less, the Goods and Services Tax (GST) of 10% of the total value of the goods listed on the invoice, international shipping costs and other fees incurred, will be added to the shipping payment by Rakuten Global Express. Rakuten Global Express will declare and pay the Goods and Services Tax (GST) to the authorities on your behalf. |

-

Those that can not be sent all over the world common

Combustible articles, high-pressure articles, etc. For details, please see "Products that cannot be delivered overseas".

Items that cannot be delivered to Australia

- Food and beverages (incl. alcoholic drinks)

- We do not accept shipping orders for food products, supplements and alcoholic beverages that require import clearance certificates or ingredients lists in advance.

- Pharmaceuticals and hygiene products

- We do not offer shipping for pharmaceuticals.

- Electrical Appliances

- There are restrictions for products containing lithium batteries, regarding the type (lithium ion, lithium metal) and quantity (max. 2 per package).

- Chemical products (detergents, liquids, cosmetics, etc.)

- An SDS may be required for chemical products (detergents, liquids, cosmetics, etc.)

- Leather and brand goods

- ・ Product details (product tags displaying material, composition) may be required.

・ Products manufactured in China require a certificate of origin.

・ A quarantine inspection certificate may be required for leather goods. - Other products of note

- ・For shipments of greater than AUD1,000, you may be required to submit detailed product information and customs documents when making your import declaration. In addition, a Goods and Services Tax (GST) of 10% of the total value of the goods listed on the invoice, plus international shipping fees and other fees incurred, may be charged by the delivery company at the time of import declaration or delivery of the goods.

・For single shipments valued at AUD1,000 or less, the Goods and Services Tax (GST) of 10% of the total value of the goods listed on the invoice, international shipping costs and other fees incurred, will be added to the shipping payment by Rakuten Global Express. Rakuten Global Express will declare and pay the Goods and Services Tax (GST) to the authorities on your behalf.

-

Those that can not be sent all over the world common

Combustible articles, high-pressure articles, etc. For details, please see "Products that cannot be delivered overseas".

Items that cannot be delivered to Australia

- Electrical Appliances

- There are restrictions for products containing lithium batteries, regarding the type (lithium ion, lithium metal) and quantity (max. 2 per package).

- Food and beverages (incl. alcoholic drinks)

- ・ We cannot import fruits, vegeatbles and related processed products.

・ Food products containing seeds, nuts, fresh fruit or vegetables, etc must go through quarantine, regardless if for personal consumption or not.

・ We cannot import meat products, except for those that can be stored at room temperature (retort pouches, cans etc).

・ We cannot import cheese, milk or related dairy products.

・ We cannot import foods containing more than 10% eggs or dairy.

・ We cannot import honey. - Pharmaceuticals and hygiene products

- The quantity restriction for pharmaceuticals in a single shipment is maximum 3 months worth as recommended by the manufacturer.

- Precious stones and metals

- We do not accept shipping orders for precious stones and metals or products containing them, such as accessories, etc.

- Other goods

- We do not accept shipping orders for tobacco.

- Other products of note

- ・For shipments of greater than AUD1,000, you may be required to submit detailed product information and customs documents when making your import declaration. In addition, a Goods and Services Tax (GST) of 10% of the total value of the goods listed on the invoice, plus international shipping fees and other fees incurred, may be charged by the delivery company at the time of import declaration or delivery of the goods.

・For single shipments valued at AUD1,000 or less, the Goods and Services Tax (GST) of 10% of the total value of the goods listed on the invoice, international shipping costs and other fees incurred, will be added to the shipping payment by Rakuten Global Express. Rakuten Global Express will declare and pay the Goods and Services Tax (GST) to the authorities on your behalf.

-

Those that can not be sent all over the world common

Combustible articles, high-pressure articles, etc. For details, please see "Products that cannot be delivered overseas".

Items that cannot be delivered to Australia

- Food and beverages (incl. alcoholic drinks)

- ・ We cannot import fruits, vegeatbles and related processed products.

・ Food products containing seeds, nuts, fresh fruit or vegetables, etc must go through quarantine, regardless if for personal consumption or not.

・ We cannot import meat products, except for those that can be stored at room temperature (retort pouches, cans etc).

・ We cannot import cheese, milk or related dairy products.

・ We cannot import foods containing more than 10% eggs or dairy.

・ We cannot import honey. - Pharmaceuticals and hygiene products

- The quantity restriction for pharmaceuticals in a single shipment is maximum 3 months worth as recommended by the manufacturer.

- Electrical Appliances

- We do not accept shipping orders for products containing lithium batteries.

- Other goods

- We do not accept shipping orders for tobacco.

- Other products of note

- ・For shipments of greater than AUD1,000, you may be required to submit detailed product information and customs documents when making your import declaration. In addition, a Goods and Services Tax (GST) of 10% of the total value of the goods listed on the invoice, plus international shipping fees and other fees incurred, may be charged by the delivery company at the time of import declaration or delivery of the goods.

・For single shipments valued at AUD1,000 or less, the Goods and Services Tax (GST) of 10% of the total value of the goods listed on the invoice, international shipping costs and other fees incurred, will be added to the shipping payment by Rakuten Global Express. Rakuten Global Express will declare and pay the Goods and Services Tax (GST) to the authorities on your behalf.

Goods and Services Tax (GST) amount judgment rate

11/2024 Judgment rate 1AUD = 100.45JPYThe following shipping methods are not available for Australia

- Economy Air

About Packing & Delivery Mode

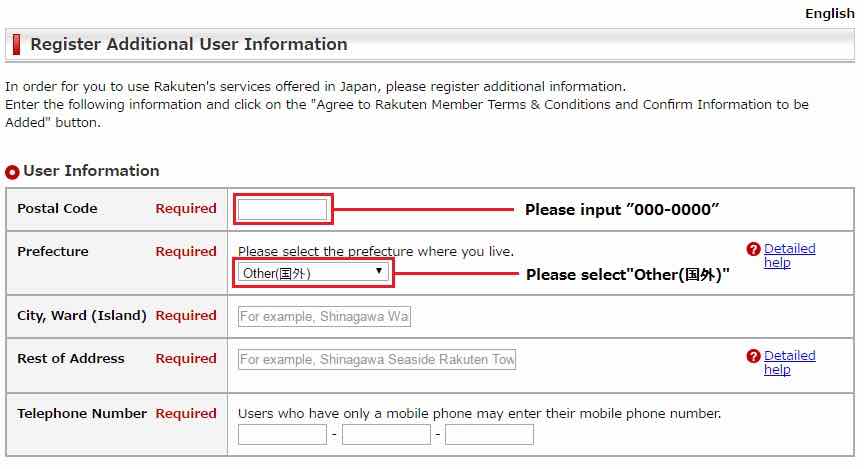

English

English