About the Goods and Services Tax (GST) in Australia

For shipping to Australia, if the total value of the items is 1,000 AUD or less, Rakuten will collect the Goods and Services Tax (GST) in addition to the shipping fee. Rakuten Global Express will declare and pay the Goods and Services Tax (GST) to the authorities on your behalf, so you will not have to pay GST by yourself and can receive items smoothly.

When should I pay Goods and Services Tax (GST)?

It varies depending on the total value of the goods.

If the total amount listed on the invoice is 1,000 AUD or less

Rakuten will collect Goods and Service Tax (GST) equal to 10% of the sum of the total amount listed on the invoice and the international shipping fees, and any other handling fees.

*You will be also charged tax administration fee (500 JPY).

If the total amount listed on the invoice is over 1,000 AUD

The delivery company will invoice Goods and Service Tax (GST) equal to 10% of the sum of the total amount listed on the invoice and the international shipping fees, and any other handling fees upon import declaration or arrival of the items.

Notes

You need to register a credit card for tax payment when you auto-ship to the countries where the Goods and Services Tax (GST) is applied.

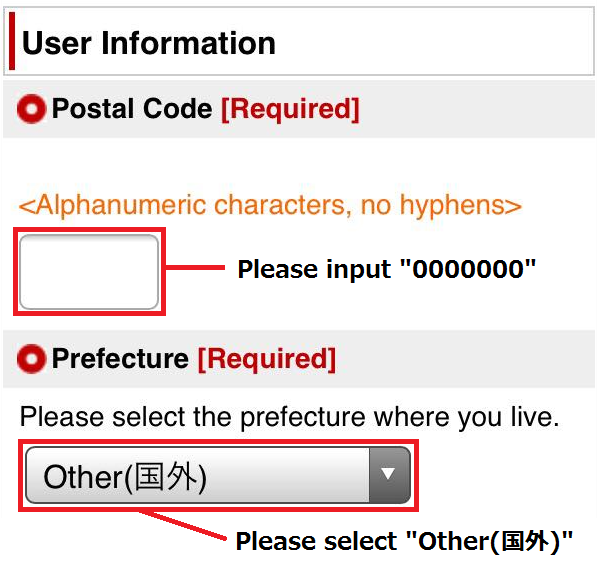

» How to register a credit card for tax payment of auto-ship

If you already paid the Goods and Services Tax (GST) to Rakuten Global Express, but the delivery company re-invoices you upon import declaration or arrival of the items, we will refund the amount via payment method you used (credit card, etc.), cash transfer to your Japanese bank account, or refund by Rakuten points (time limited points).

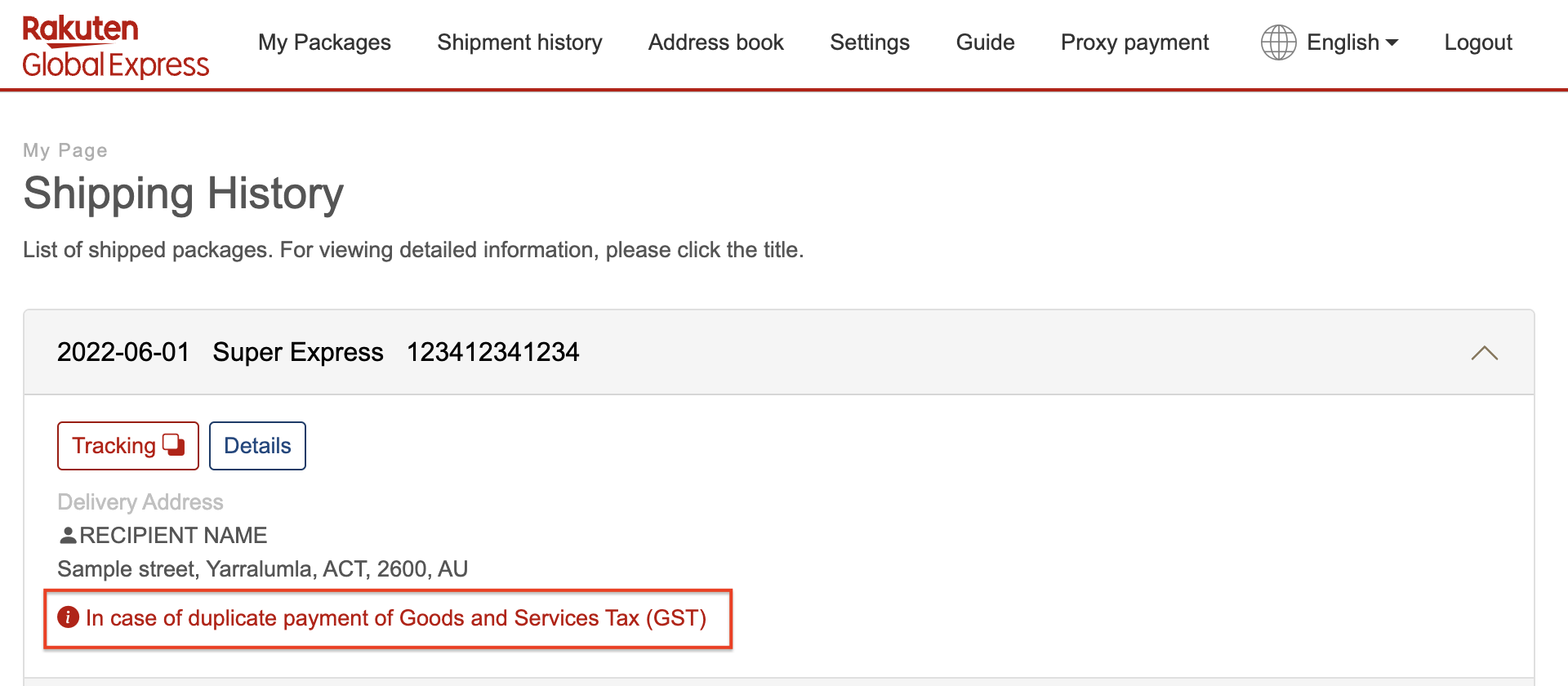

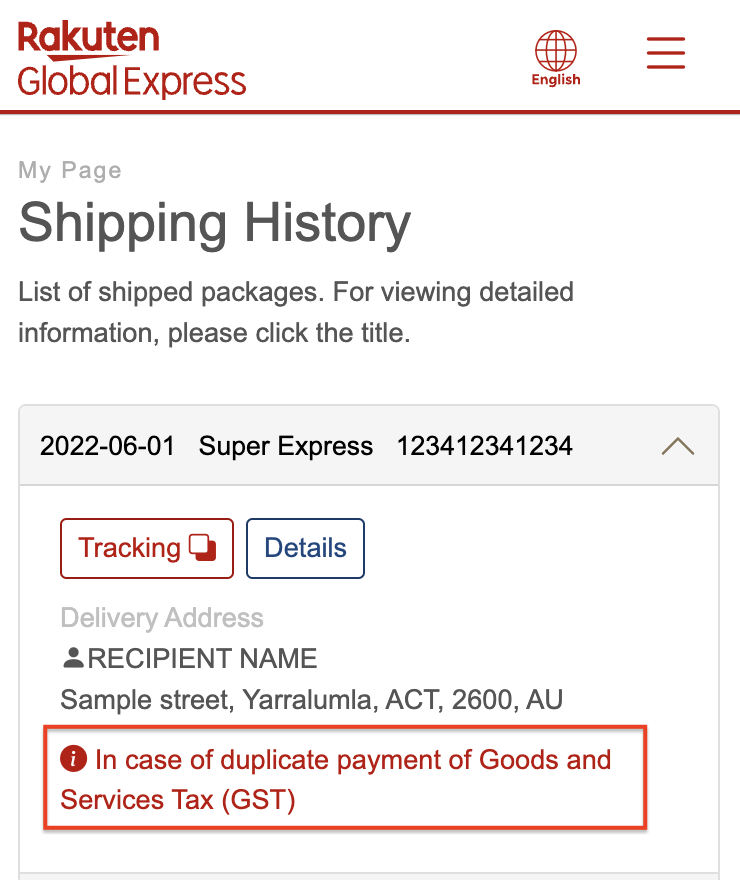

Please select the relevant package on the shipping history page, and click “In case of duplicate payment of Goods and Services Tax (GST)” to proceed to the inquiry form. Your receipt for the payment to the delivery company is required.

» Shipping History

*Login required.

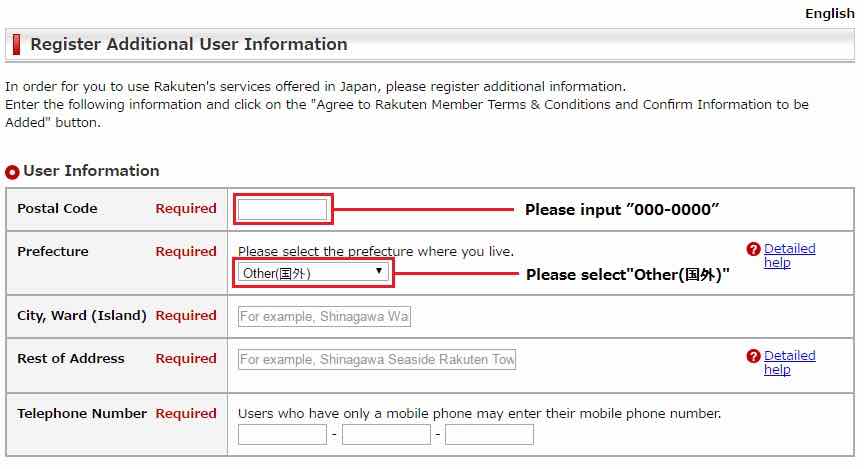

Shipping history Sample

Disclaimer

- We will calculate the total amount at the exchange rate we refer.

- The contents of this page refer to Goods and Services Tax (GST), not import customs duty. If customs duty is incurred for import, additional payment will be requested upon arrival of the items.

- Points are not granted for payment of the Goods and Services Tax (GST).

- In the event of a conflict between the translations of this website, the Japanese translation shall prevail.

English

English