About the Value Added Tax (VAT) in UK

For shipping to the UK, if the total value of the items is 135 GBP or less, Rakuten will collect the Value Added Tax (VAT) in addition to the shipping fee.

Rakuten Global Express will declare and pay the Value Added Tax (VAT) to the authorities on your behalf, so you will not have to pay VAT by yourself and can receive items smoothly. *Reduced tax rate currently not applied.

When should I pay Value Added Tax (VAT)?

It varies depending on the total value of the goods.

If the total amount listed on the invoice is 135GBP or less

Rakuten will collect Value Added Tax (VAT) equal to 20% of the sum of the total amount listed on the invoice and the international shipping fees, and any other handling fees.

*You will be also charged tax administration fee (500 JPY).

If the total amount listed on the invoice is over 135GBP

The delivery company will invoice Value Added Tax (VAT) equal to 20% of the sum of the total amount listed on the invoice and the international shipping fees, and any other handling fees upon import declaration or arrival of the items.

Notes

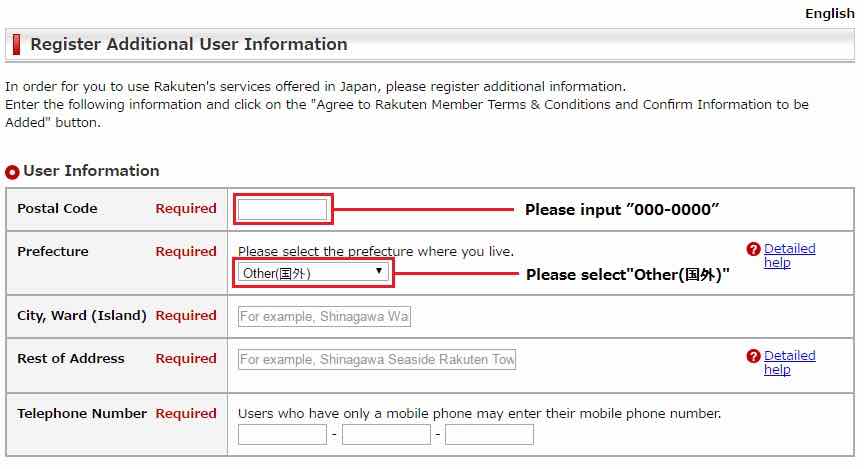

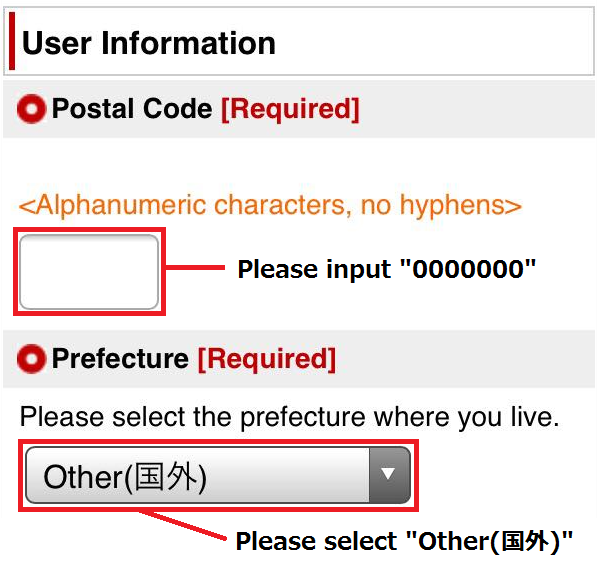

You need to register a credit card for tax payment when you auto-ship to the countries where the Value Added Tax (VAT) is applied.

» How to register a credit card for tax payment of auto-ship

If you already paid the Value Added Tax (VAT) to Rakuten Global Express, but the delivery company re-invoices you upon import declaration or arrival of the items, we will refund the amount via payment method you used (credit card, etc.), cash transfer to your Japanese bank account, or refund by Rakuten points (time limited points).

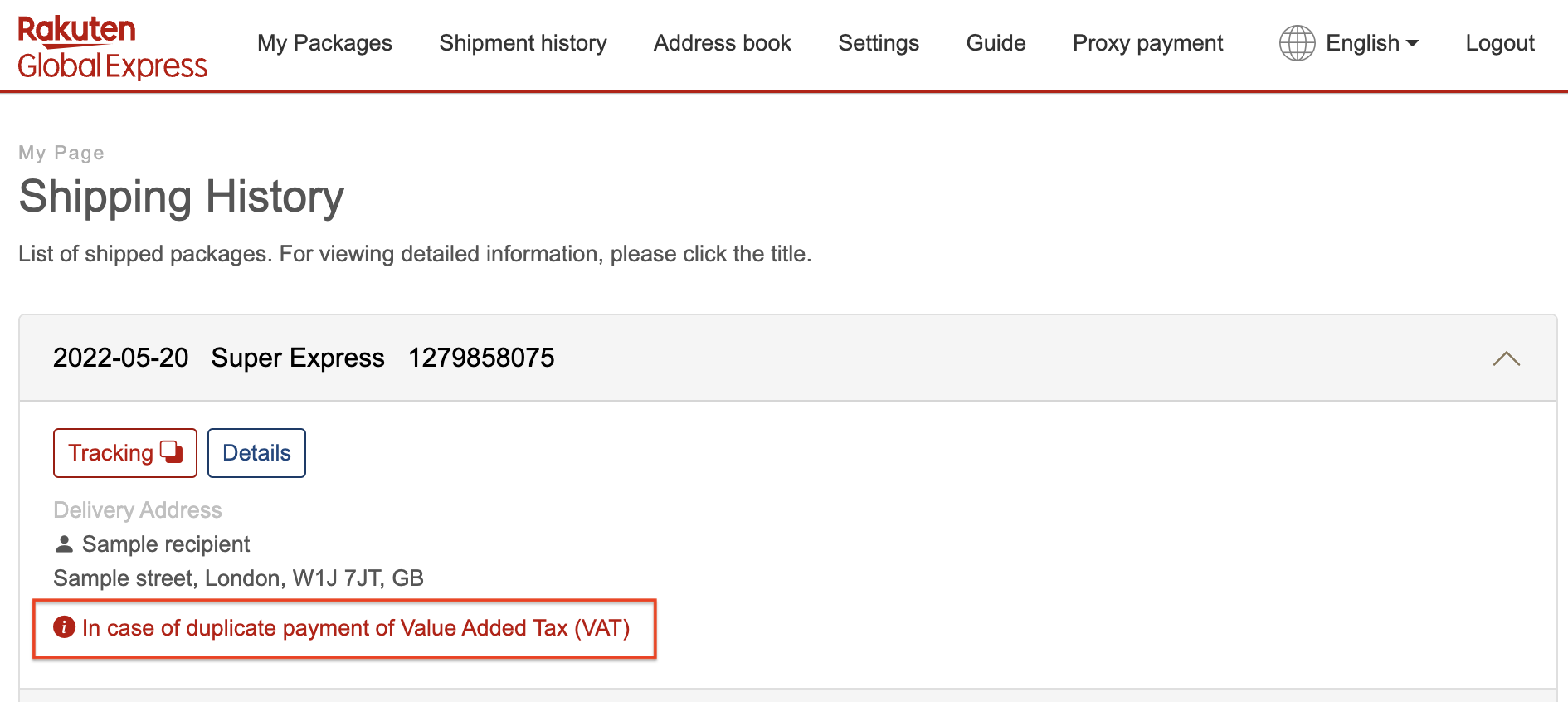

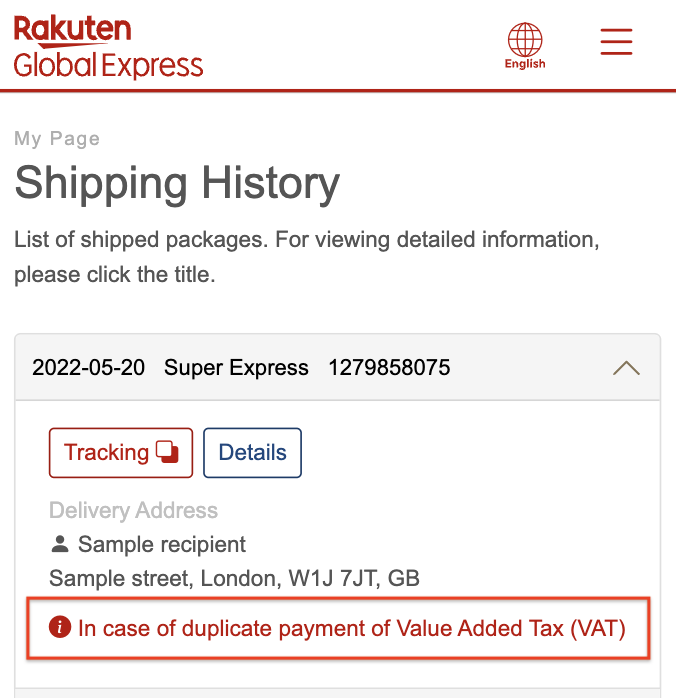

Please select the relevant package on the shipping history page, and click “In case of duplicate payment of Value Added Tax (VAT)” to proceed to the inquiry form. Your receipt for the payment to the delivery company is required.

» Shipping History

*Login required.

Shipping history Sample

Disclaimer

- We will calculate the total amount at the exchange rate we refer.

- Reduced tax rate currently not applied.

- The contents of this page refer to Value Added Tax (VAT), not import customs duty. If customs duty is incurred for import, additional payment will be requested upon arrival of the items.

- Points are not granted for payment of the Value Added Tax (VAT).

- In the event of a conflict between the translations of this website, the Japanese translation shall prevail.

English

English