Regulations on export to Republic of Korea

When you send your luggage to Republic of Korea, Please check the following transport, and the regulations on import and export.

Although we pay close attention to the accuracy of the information, the laws and regulations of each country and region are subject to change. Please be sure to check the import regulations of each country before using.

Shipping fee to Republic of Korea is here >>

Contraband list for Republic of Korea

The restrictions on the items that can be sent vary depending on the delivery method. For more details, please check the restrictions of each shipping method below.

Super Express

Standard Express

Economy Air

Surface

Those that can not be sent all over the world common

Combustible articles, high-pressure articles, etc. For details, please see "Products that cannot be delivered overseas".

Items that cannot be delivered to Republic of Korea

| Food and beverages (incl. alcoholic drinks) | We cannot accept requests for shipping food products, supplements, or alcohol. |

|---|---|

| Cosmetics | There are quantity limits based on the estimated limit for personal use. |

| Pharmaceuticals and hygiene products | ・We cannot accept requests for shipping spectacles or contact lenses. ・We do not offer shipping for pharmaceuticals. |

| Electrical Appliances | ・There are restrictions for products containing lithium batteries, regarding the type (lithium ion, lithium metal) and quantity (max. 2 per package). ・A license is required for products with wireless functionality. |

| Cleaners and washing liquids | SDS may be requested in the case of fluids. |

| Leather and brand goods | A quarantine inspection certificate may be required for leather goods. |

Those that can not be sent all over the world common

Combustible articles, high-pressure articles, etc. For details, please see "Products that cannot be delivered overseas".

Items that cannot be delivered to Republic of Korea

| Food and beverages (incl. alcoholic drinks) | ・Vegetables (other than tomatoes or pumpkins) cannot be imported ・Fruit cannot be imported ・Salt cannot be imported ・Meat cannot be imported ・Seafood from Fukushima, Miyagi, Iwate, Aomori, Gunma, Tochigi, Ibaragi, and Chiba prefectures cannot be imported ・For all other products, a radioactive material inspection certificate may be required ・Even in cases where an inspection certificate is not required, a certificate of origin will be necessary ・Alcoholic Beverages We offer shipping for quantities up to 1 liter. |

|---|---|

| Electrical Appliances | There are restrictions for products containing lithium batteries, regarding the type (lithium ion, lithium metal) and quantity (max. 2 per package). |

| Precious stones and metals | We cannot accept requests for shipping valuables and accessories containing precious metals. |

| Other products of note | Custom duties shall be exempted in the case of imports for the following small amounts. ・When they are goods for small amounts that will be received by a Korean resident, and the total taxable amount is 100,000 won or below *However, in the case of repeatedly imported parts or parts sent in installments, such items may be excluded based on criteria determined by the Customs Service Director. ・The operational management criteria for multiple low-value imports from overseas suppliers (online shopping malls, etc.) that fall within the range of tax exemption are as follows. For imports from the same overseas supplier with two or more import declarations made on the same day: The imports will be taxed jointly. However, goods transported from different countries will be taxed separately. If the import declarations are made separately on different days: Tax exemptions are available for individual imports if the goods are deemed to be for personal use. However, if an analysis of the information reveals that the goods were ineligible for tax exemption, the appropriate amount will be recovered subsequently. For imports that are taxed jointly, custom tax and VAT will only be waived if the total value of the goods is less than $150. Goods with a total value that exceeds the threshold stipulated by the customs ($150, or $200 for the U.S.) will require a formal import declaration. |

Those that can not be sent all over the world common

Combustible articles, high-pressure articles, etc. For details, please see "Products that cannot be delivered overseas".

Items that cannot be delivered to Republic of Korea

| Cosmetics | There are quantity limits based on the estimated limit for personal use. |

|---|---|

| Pharmaceuticals and hygiene products | ・We cannot accept requests for shipping spectacles or contact lenses. ・We do not offer shipping for pharmaceuticals. |

| Food and beverages (incl. alcoholic drinks) | ・Vegetables (other than tomatoes or pumpkins) cannot be imported ・Fruit cannot be imported ・Salt cannot be imported ・Meat cannot be imported ・Seafood from Fukushima, Miyagi, Iwate, Aomori, Gunma, Tochigi, Ibaragi, and Chiba prefectures cannot be imported ・For all other products, a radioactive material inspection certificate may be required ・Even in cases where an inspection certificate is not required, a certificate of origin will be necessary ・Instant and retort food products (products containing meat, seafood, and eggs) cannot be imported. ・Alcoholic Beverages: We offer shipping for quantities up to 750 Milliliter. |

| Electrical Appliances | There are restrictions for products containing lithium batteries, regarding the type (lithium ion, lithium metal) and quantity (max. 2 per package). |

| Precious stones and metals | We cannot accept requests for shipping valuables and accessories containing precious metals. |

| Other goods | We cannot ship pet food. |

| Other products of note | ・We cannot ship packages with individual value (in the case of multiple products, the total value) of over 200,000 yen. ・Custom duties shall be exempted in the case of imports for the following small amounts. ・When they are goods for small amounts that will be received by a Korean resident, and the total taxable amount is 100,000 won or below *However, in the case of repeatedly imported parts or parts sent in installments, such items may be excluded based on criteria determined by the Customs Service Director. ・The operational management criteria for multiple low-value imports from overseas suppliers (online shopping malls, etc.) that fall within the range of tax exemption are as follows. For imports from the same overseas supplier with two or more import declarations made on the same day: The imports will be taxed jointly. However, goods transported from different countries will be taxed separately. If the import declarations are made separately on different days: Tax exemptions are available for individual imports if the goods are deemed to be for personal use. However, if an analysis of the information reveals that the goods were ineligible for tax exemption, the appropriate amount will be recovered subsequently. For imports that are taxed jointly, custom tax and VAT will only be waived if the total value of the goods is less than $150. Goods with a total value that exceeds the threshold stipulated by the customs ($150, or $200 for the U.S.) will require a formal import declaration. ・ The submission of a PCC (Personal Customs Code) is required. A foreign consignee can subsequently substitute a passport, but a PCC application and obtainment are also possible. If the procedure is not complete, the export procedure from Japan may be delayed. Please check FAQ for further details. |

Those that can not be sent all over the world common

Combustible articles, high-pressure articles, etc. For details, please see "Products that cannot be delivered overseas".

Items that cannot be delivered to Republic of Korea

| Food and beverages (incl. alcoholic drinks) | ・Vegetables (other than tomatoes or pumpkins) cannot be imported ・Fruit cannot be imported ・Salt cannot be imported ・Meat cannot be imported ・Seafood from Fukushima, Miyagi, Iwate, Aomori, Gunma, Tochigi, Ibaragi, and Chiba prefectures cannot be imported ・For all other products, a radioactive material inspection certificate may be required ・Even in cases where an inspection certificate is not required, a certificate of origin will be necessary ・Alcoholic Beverages We offer shipping for quantities up to 1 liter. |

|---|---|

| Electrical Appliances | There are restrictions for products containing lithium batteries, regarding the type (lithium ion, lithium metal) and quantity (max. 2 per package). |

| Other products of note | Custom duties shall be exempted in the case of imports for the following small amounts. ・When they are goods for small amounts that will be received by a Korean resident, and the total taxable amount is 100,000 won or below *However, in the case of repeatedly imported parts or parts sent in installments, such items may be excluded based on criteria determined by the Customs Service Director. ・The operational management criteria for multiple low-value imports from overseas suppliers (online shopping malls, etc.) that fall within the range of tax exemption are as follows. For imports from the same overseas supplier with two or more import declarations made on the same day: The imports will be taxed jointly. However, goods transported from different countries will be taxed separately. If the import declarations are made separately on different days: Tax exemptions are available for individual imports if the goods are deemed to be for personal use. However, if an analysis of the information reveals that the goods were ineligible for tax exemption, the appropriate amount will be recovered subsequently. For imports that are taxed jointly, custom tax and VAT will only be waived if the total value of the goods is less than $150. Goods with a total value that exceeds the threshold stipulated by the customs ($150, or $200 for the U.S.) will require a formal import declaration. |

-

Those that can not be sent all over the world common

Combustible articles, high-pressure articles, etc. For details, please see "Products that cannot be delivered overseas".

Items that cannot be delivered to Republic of Korea

- Food and beverages (incl. alcoholic drinks)

- We cannot accept requests for shipping food products, supplements, or alcohol.

- Cosmetics

- There are quantity limits based on the estimated limit for personal use.

- Pharmaceuticals and hygiene products

- ・We cannot accept requests for shipping spectacles or contact lenses.

・We do not offer shipping for pharmaceuticals. - Electrical Appliances

- ・There are restrictions for products containing lithium batteries, regarding the type (lithium ion, lithium metal) and quantity (max. 2 per package).

・A license is required for products with wireless functionality. - Cleaners and washing liquids

- SDS may be requested in the case of fluids.

- Leather and brand goods

- A quarantine inspection certificate may be required for leather goods.

-

Those that can not be sent all over the world common

Combustible articles, high-pressure articles, etc. For details, please see "Products that cannot be delivered overseas".

Items that cannot be delivered to Republic of Korea

- Food and beverages (incl. alcoholic drinks)

- ・Vegetables (other than tomatoes or pumpkins) cannot be imported

・Fruit cannot be imported

・Salt cannot be imported

・Meat cannot be imported

・Seafood from Fukushima, Miyagi, Iwate, Aomori, Gunma, Tochigi, Ibaragi, and Chiba prefectures cannot be imported

・For all other products, a radioactive material inspection certificate may be required

・Even in cases where an inspection certificate is not required, a certificate of origin will be necessary

・Alcoholic Beverages We offer shipping for quantities up to 1 liter. - Electrical Appliances

- There are restrictions for products containing lithium batteries, regarding the type (lithium ion, lithium metal) and quantity (max. 2 per package).

- Precious stones and metals

- We cannot accept requests for shipping valuables and accessories containing precious metals.

- Other products of note

- Custom duties shall be exempted in the case of imports for the following small amounts.

・When they are goods for small amounts that will be received by a Korean resident, and the total taxable amount is 100,000 won or below

*However, in the case of repeatedly imported parts or parts sent in installments, such items may be excluded based on criteria determined by the Customs Service Director.

・The operational management criteria for multiple low-value imports from overseas suppliers (online shopping malls, etc.) that fall within the range of tax exemption are as follows.

For imports from the same overseas supplier with two or more import declarations made on the same day: The imports will be taxed jointly. However, goods transported from different countries will be taxed separately.

If the import declarations are made separately on different days: Tax exemptions are available for individual imports if the goods are deemed to be for personal use. However, if an analysis of the information reveals that the goods were ineligible for tax exemption, the appropriate amount will be recovered subsequently.

For imports that are taxed jointly, custom tax and VAT will only be waived if the total value of the goods is less than $150. Goods with a total value that exceeds the threshold stipulated by the customs ($150, or $200 for the U.S.) will require a formal import declaration.

-

Those that can not be sent all over the world common

Combustible articles, high-pressure articles, etc. For details, please see "Products that cannot be delivered overseas".

Items that cannot be delivered to Republic of Korea

- Cosmetics

- There are quantity limits based on the estimated limit for personal use.

- Pharmaceuticals and hygiene products

- ・We cannot accept requests for shipping spectacles or contact lenses.

・We do not offer shipping for pharmaceuticals. - Food and beverages (incl. alcoholic drinks)

- ・Vegetables (other than tomatoes or pumpkins) cannot be imported

・Fruit cannot be imported

・Salt cannot be imported

・Meat cannot be imported

・Seafood from Fukushima, Miyagi, Iwate, Aomori, Gunma, Tochigi, Ibaragi, and Chiba prefectures cannot be imported

・For all other products, a radioactive material inspection certificate may be required

・Even in cases where an inspection certificate is not required, a certificate of origin will be necessary

・Instant and retort food products (products containing meat, seafood, and eggs) cannot be imported.

・Alcoholic Beverages: We offer shipping for quantities up to 750 Milliliter. - Electrical Appliances

- There are restrictions for products containing lithium batteries, regarding the type (lithium ion, lithium metal) and quantity (max. 2 per package).

- Precious stones and metals

- We cannot accept requests for shipping valuables and accessories containing precious metals.

- Other goods

- We cannot ship pet food.

- Other products of note

- ・We cannot ship packages with individual value (in the case of multiple products, the total value) of over 200,000 yen.

・Custom duties shall be exempted in the case of imports for the following small amounts.

・When they are goods for small amounts that will be received by a Korean resident, and the total taxable amount is 100,000 won or below

*However, in the case of repeatedly imported parts or parts sent in installments, such items may be excluded based on criteria determined by the Customs Service Director.

・The operational management criteria for multiple low-value imports from overseas suppliers (online shopping malls, etc.) that fall within the range of tax exemption are as follows.

For imports from the same overseas supplier with two or more import declarations made on the same day: The imports will be taxed jointly. However, goods transported from different countries will be taxed separately.

If the import declarations are made separately on different days: Tax exemptions are available for individual imports if the goods are deemed to be for personal use. However, if an analysis of the information reveals that the goods were ineligible for tax exemption, the appropriate amount will be recovered subsequently.

For imports that are taxed jointly, custom tax and VAT will only be waived if the total value of the goods is less than $150. Goods with a total value that exceeds the threshold stipulated by the customs ($150, or $200 for the U.S.) will require a formal import declaration.

・ The submission of a PCC (Personal Customs Code) is required. A foreign consignee can subsequently substitute a passport, but a PCC application and obtainment are also possible. If the procedure is not complete, the export procedure from Japan may be delayed. Please check FAQ for further details.

-

Those that can not be sent all over the world common

Combustible articles, high-pressure articles, etc. For details, please see "Products that cannot be delivered overseas".

Items that cannot be delivered to Republic of Korea

- Food and beverages (incl. alcoholic drinks)

- ・Vegetables (other than tomatoes or pumpkins) cannot be imported

・Fruit cannot be imported

・Salt cannot be imported

・Meat cannot be imported

・Seafood from Fukushima, Miyagi, Iwate, Aomori, Gunma, Tochigi, Ibaragi, and Chiba prefectures cannot be imported

・For all other products, a radioactive material inspection certificate may be required

・Even in cases where an inspection certificate is not required, a certificate of origin will be necessary

・Alcoholic Beverages We offer shipping for quantities up to 1 liter. - Electrical Appliances

- There are restrictions for products containing lithium batteries, regarding the type (lithium ion, lithium metal) and quantity (max. 2 per package).

- Other products of note

- Custom duties shall be exempted in the case of imports for the following small amounts.

・When they are goods for small amounts that will be received by a Korean resident, and the total taxable amount is 100,000 won or below

*However, in the case of repeatedly imported parts or parts sent in installments, such items may be excluded based on criteria determined by the Customs Service Director.

・The operational management criteria for multiple low-value imports from overseas suppliers (online shopping malls, etc.) that fall within the range of tax exemption are as follows.

For imports from the same overseas supplier with two or more import declarations made on the same day: The imports will be taxed jointly. However, goods transported from different countries will be taxed separately.

If the import declarations are made separately on different days: Tax exemptions are available for individual imports if the goods are deemed to be for personal use. However, if an analysis of the information reveals that the goods were ineligible for tax exemption, the appropriate amount will be recovered subsequently.

For imports that are taxed jointly, custom tax and VAT will only be waived if the total value of the goods is less than $150. Goods with a total value that exceeds the threshold stipulated by the customs ($150, or $200 for the U.S.) will require a formal import declaration.

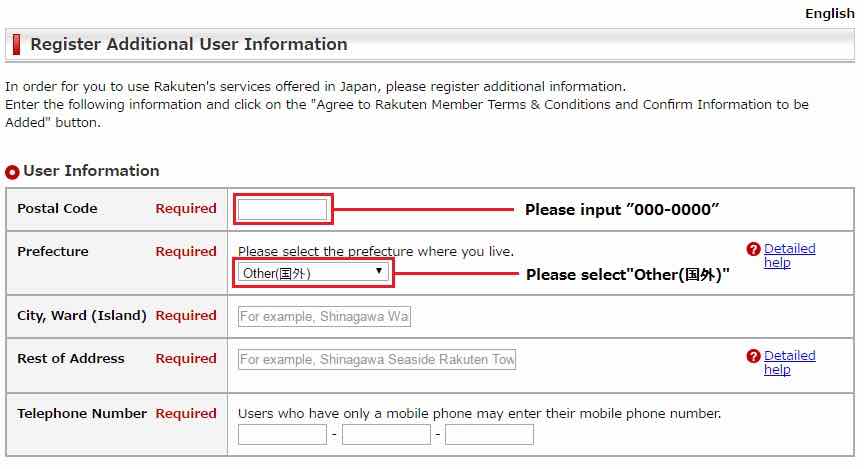

About Packing & Delivery Mode

English

English